Board Room VS Break Room

PHD. Philosophy

Assessing the need of the employee and employer to provide the best possible retirement plans that produce healthy outcomes.

Board Room

With large retirement plans the focus is generally on the Board Room ONLY. If a consultant is involved they are most likely delivering trustee or fiduciary services, not offering personalized employee meetings or guidance. This is the Pension Model or Defined Benefit model, applying a DB model to 401(k) and 403(b) plans.

Break Room

With small retirement plans the focus is generally on the Break Room ONLY. The advisor may visit the Board Room to deliver a review but they focus on the Break Room, offering employee meetings. This is the Insurance Model, focused on selling insurance to employees in the Break Room. It’s profitable for the advisor and the insurance company but not necessarily beneficial for the retirement plan.

The benefits of following the Pension Model are it may be more cost-effective for the employer and it’s definitely “safer” for the plan’s fiduciaries because this conservative approach emphasizes plan compliance. Unfortunately, when the plan participants receive little if any help or attention it yields the least effective results for healthy participant outcomes, according to the Allianz Center for Behavioral Finance. With any plan we believe in a balanced focus on both the Board Room and the Break Room, regardless of size.

While the Insurance Model may yield better individual results with individualized assistance it may also cost the company and the employees a great deal more. Sometimes the “individualized assistance” comes with a big price tag in the form of a “Managed Accounts” program that could add an additional drag on returns, or sometimes the advice is offered in violation of Department of Labor Advisory Opinion Letter 2001-09A.

According to the U.S. Government Accountability Office, even a 1% difference in fees can reduce retirement benefits by nearly 20% over the course of an employee’s career. And in addition to managed portfolio solutions, “individualized assistance” can mean an opportunity for the advisor to sell additional insurance products to the employees which could violate ERISA 406(a) and AO 2001-09A. Unleashing insurance agents on the employees increases the fiduciary liability for the employer. But the “Break Room focus” may not be concerned with the fiduciary risk of those in the Board Room.

With any plan we believe in a balanced focus on both the Board Room and the Break Room regardless of size.

Board Room

(With large retirement plans the focus is generally on the Board Room ONLY. If a consultant is involved they are most likely delivering trustee or fiduciary services, not offering personalized employee meetings or guidance. This is the Pension Model or Defined Benefit model, applying a DB model to 401(k) and 403(b) plans.

The benefits of following the Pension Model are; It’s generally more cost-effective for the employer and it’s definitely “safer” for the plan’s fiduciaries because this conservative approach emphasizes plan compliance. Unfortunately, when the plan participants receive little if any help or attention it yields the least effective results for healthy participant outcomes, according to the Allianz Center for Behavioral Finance. With any plan we believe in a balanced focus on both the Board Room and the Break Room, regardless of size.

Break Room

With small retirement plans the focus is generally on the Break Room ONLY. The advisor may visit the Board Room to deliver a review but focus on the Break Room, offering personalized employee meetings. This is the Insurance Model, focused on selling insurance to employees in the Break Room. It’s profitable for the advisor and the insurance company but not necessarily beneficial for the retirement plan.

While the Insurance Model may yield better individual results with individualized assistance it may also cost the company and the employees a great deal more. Sometimes the “individualized assistance” comes with a big price tag in the form of a “Managed Accounts” program that could add an additional drag on returns, or sometimes the advice is offered in violation of Department of Labor, Advisory opinion letter 2001-09A.

According to the U.S. Government Accountability Office, even a 1% difference in fees can reduce retirement benefits by nearly 20% over the course of an employee’s career. And in addition to managed portfolio solutions, “individualized assistance” can mean an opportunity for the advisor to sell additional insurance products to the employees which could violate ERISA 406(a) and AO 2001-09A. Unleashing insurance agents on the employees increases the fiduciary liability for the employer. But the “Break Room focus” may not be concerned with the fiduciary risk of those in the Board Room.

With any plan we believe in a balanced focus on both the Board Room and the Break Room regardless of size.

Why this is important

We believe a balanced focus between Healthy Plans and Healthy Outcomes depend on the Board Room and Break Room. At PHD. Retirement Consulting we adhere to the Independent Consultants Model, a Fee-only focus rather than a commission sales approach, where we will take responsibility in writing for our co-fiduciary role with the plan.

Our goal when working with the employer is to make their job easier (“No Worries”), to design a plan that works, and to help the employer keep the plan in compliance. Our goal when working with the employees is to provide robust education and guidance that supports the decisions in the Board Room, to make sure that participants have access to the individualized assistance that they need, but never to make clients out of the individual employees. We do not sell any products to employees. In fact, we believe this is a violation of ERISA 406(b), defined as a “conflict of interest.”

Guidelines under ERISA suggest it is not possible to be a fiduciary to the plan and to the plan’s participants. In other words, it’s a conflict of interest to advise on the investment lineup when some investments may compensate the advisor better than others.

Similarly it’s a conflict of interest when the same retirement plan yields multiple streams of revenue to the same advisor, such as commissions or plan

level fees, plus managed account fees, plus commission revenue from retail sales to individual employees. Best Practices suggest compensation for the two services (to the employer and the employee) be separate.

We believe a balanced focus between Healthy Plans and Healthy Outcomes depend on the Board Room and Break Room. At PHD. Retirement Consulting we adhere to the Independent Consultants Model, a Fee-only focus rather than a commission sales approach, where we will take responsibility in writing for our co-fiduciary role with the plan.

Our goal when working with the employer is to make their job easier (“No Worries”), to design a plan that works, and to help the employer keep the plan in compliance. Our goal when working with the employees is to provide robust education and guidance that supports the decisions in the Board Room, to make sure that participants have access to the individualized assistance that they need, but never to make clients out of the individual employees. We do not sell any products to employees. In fact, we believe this is a violation of ERISA 406(b), defined as a “conflict of interest.”

Guidelines under ERISA suggest it is not possible to be a fiduciary to the plan and to the plan’s participants. In other words, it’s a conflict of interest to advise on the investment lineup when some investments may compensate the advisor better than others.

Similarly it’s a conflict of interest when the same retirement plan yields multiple streams of revenue to the same advisor, such as commissions or plan level fees, plus managed account fees, plus commission revenue from retail sales to individual employees. Best Practices suggest compensation for the two services (to the employer and the employee) be separate.

Healthy Plans Make Healthy Outcomes

Healthy Retirement Plans

At PHD. Retirement Consultants we believe the process starts with designing and building a healthy retirement plan. Just as a company’s medical benefits are supported with a Wellness Plan, we believe that a company’s retirement benefits should be undergirded with a Health and Wellness System that supports compliance, due diligence and proper fiduciary oversight while also producing healthy outcomes. The ingredients of a healthy retirement plan include adherence to Best Practices under ERISA (Employee Retirement Income Security Act).

Healthy Plans Make Healthy Outcomes

Healthy Retirement Outcomes

At PHD. Retirement Consultants we believe that a healthy retirement plan produces healthy retirement outcomes. After all, if the plan itself is functioning properly and legally and everything is in compliance and yet the plan participants don’t have enough money to retire on time, what’s the point? We focus on measurable outcomes and utilize third-party benchmarking studies to reference our scorecards and demonstrate that the plan is always working towards improvements in health. The goal of our client-focused, participant-centric model is producing happy and healthy employees who understand, appreciate and participate in the company retirement plan. One of our objectives is to build employee morale around the benefits that the company offers as savings increase. The ingredients of healthy retirement plan outcomes starts with a focus on your company’s most valuable resources, your Human Resources.

Healthy Plans Make Healthy Outcomes

Healthy Retirement Outcomes

At PHD. Retirement Consultants we believe that a healthy retirement plan produces healthy retirement outcomes. After all, if the plan itself is functioning properly and legally and everything is in compliance and yet the plan participants don’t have enough money to retire on time, what’s the point? We focus on measurable outcomes and utilize third-party benchmarking studies to reference our scorecards and demonstrate that the plan is always working towards improvements in health. The goal of our client-focused, participant-centric model is producing happy and healthy employees who understand, appreciate and participate in the company retirement plan. One of our objectives is to build employee morale around the benefits that the company offers as savings increase. The ingredients of healthy retirement plan outcomes starts with a focus on your company’s most valuable resources, your Human Resources.

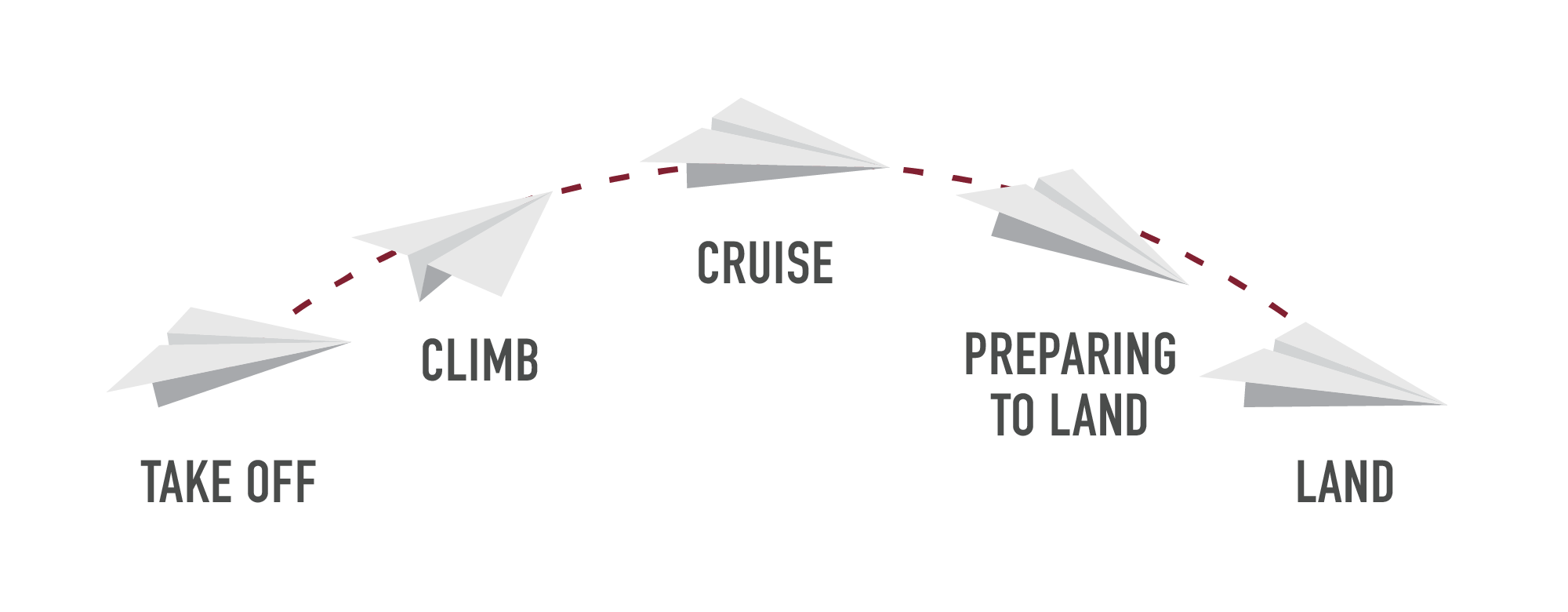

The Flight Path for a Healthy Retirement Plan

– hover over each airplane to reveal the description –

Take Off

What are the defaults for the retirement plan, and are they set to help or harm the objective of getting every employee across the finish line? We’d hate for the plane to take off with anyone left behind. Our team excels in getting everybody on board

Climb

The participants in a retirement plan don’t just automatically climb towards their retirement goals unless there is an intentional and purposeful effort to facilitate the process. If fees are excessive, if contributions are low, or if the communication and guidance in the Break Room is not on target, the gravitational pull will prevent success.

Cruise

The participants in a retirement plan have the opportunity to set the flight to cruise control once they reach their cruising altitude, meaning proper diversification and rebalancing of their account along a customized glidepath. Using cruise control should mean less turbulence over the course of the journey and should promote better long-term success.

Preparing to Land

The closer an employee gets to the end of their journey the greater the importance of customized personal guidance. Have they considered where they’d like to land, and when they can land, and how much fuel they need to land? Have they factored into the equation Social Security and ongoing health care costs? It is important to sit down with a coach for in-depth planning, a trusted planner who embodies a teacher’s heart and a servant mindset. Finding the right pilot is key.

Land

There is so much attention on the accumulation process towards retirement, and too little focus on the distribution process. How an employee lands is critical. A safe landing is vital to success and there is nothing automatic about the process. A successful landing means avoiding coming down in a dangerous spot, like a down market or a runway littered with annuities that can erode years of hard work with excessive fees. Landing the plan may be the most dangerous part of flying and must be left to the professionals.

No Commission | Fee-only focus

We help employees retire better

and we help employers sleep better

“If your employees matter to you they matter to us”

“Our goal is to get every employee across the finish line”

“We’ll meet with any employee, any time, anywhere. Just because we care”

Get In Touch

(844) PHD-401k

Location

7500 College Blvd., Suite 500,

Overland Park, Kansas 66210.